Autocorrelation

Autocorrelation is the cross-correlation of a signal with itself. Informally, it is the similarity between observations as a function of the time separation between them. It is a mathematical tool for finding repeating patterns, such as the presence of a periodic signal which has been buried under noise, or identifying the missing fundamental frequency in a signal implied by its harmonic frequencies. It is often used in signal processing for analyzing functions or series of values, such as time domain signals.

Contents |

Definitions

Different fields of study define autocorrelation differently, and not all of these definitions are equivalent. In some fields, the term is used interchangeably with autocovariance.

Statistics

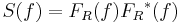

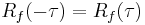

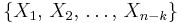

In statistics, the autocorrelation of a random process describes the correlation between values of the process at different points in time, as a function of the two times or of the time difference. Let X be some repeatable process, and i be some point in time after the start of that process. (i may be an integer for a discrete-time process or a real number for a continuous-time process.) Then Xi is the value (or realization) produced by a given run of the process at time i. Suppose that the process is further known to have defined values for mean μi and variance σi2 for all times i. Then the definition of the autocorrelation between times s and t is

where "E" is the expected value operator. Note that this expression is not well-defined for all time series or processes, because the variance may be zero (for a constant process) or infinite. If the function R is well-defined, its value must lie in the range [−1, 1], with 1 indicating perfect correlation and −1 indicating perfect anti-correlation.

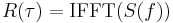

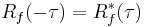

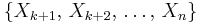

If Xt is a second-order stationary process then the mean μ and the variance σ2 are time-independent, and further the autocorrelation depends only on the difference between t and s: the correlation depends only on the time-distance between the pair of values but not on their position in time. This further implies that the autocorrelation can be expressed as a function of the time-lag, and that this would be an even function of the lag τ = s − t. This gives the more familiar form

and the fact that this is an even function can be stated as

It is common practice in some disciplines, other than statistics and time series analysis, to drop the normalization by σ2 and use the term "autocorrelation" interchangeably with "autocovariance". However, the normalization is important both because the interpretation of the autocorrelation as a correlation provides a scale-free measure of the strength of statistical dependence, and because the normalization has an effect on the statistical properties of the estimated autocorrelations.

Signal processing

In signal processing, the above definition is often used without the normalization, that is, without subtracting the mean and dividing by the variance. When the autocorrelation function is normalized by mean and variance, it is sometimes referred to as the autocorrelation coefficient.[1]

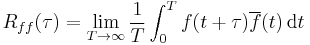

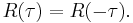

Given a signal  , the continuous autocorrelation

, the continuous autocorrelation  is most often defined as the continuous cross-correlation integral of

is most often defined as the continuous cross-correlation integral of  with itself, at lag

with itself, at lag  .

.

where  represents the complex conjugate and

represents the complex conjugate and  represents convolution. For a real function,

represents convolution. For a real function,  .

.

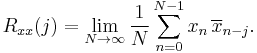

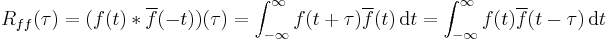

The discrete autocorrelation  at lag

at lag  for a discrete signal

for a discrete signal  is

is

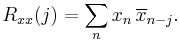

The above definitions work for signals that are square integrable, or square summable, that is, of finite energy. Signals that "last forever" are treated instead as random processes, in which case different definitions are needed, based on expected values. For wide-sense-stationary random processes, the autocorrelations are defined as

For processes that are not stationary, these will also be functions of  , or

, or  .

.

For processes that are also ergodic, the expectation can be replaced by the limit of a time average. The autocorrelation of an ergodic process is sometimes defined as or equated to[1]

These definitions have the advantage that they give sensible well-defined single-parameter results for periodic functions, even when those functions are not the output of stationary ergodic processes.

Alternatively, signals that last forever can be treated by a short-time autocorrelation function analysis, using finite time integrals. (See short-time Fourier transform for a related process.)

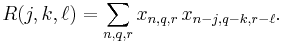

Multi-dimensional autocorrelation is defined similarly. For example, in three dimensions the autocorrelation of a square-summable discrete signal would be

When mean values are subtracted from signals before computing an autocorrelation function, the resulting function is usually called an auto-covariance function.

Properties

In the following, we will describe properties of one-dimensional autocorrelations only, since most properties are easily transferred from the one-dimensional case to the multi-dimensional cases.

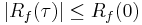

- A fundamental property of the autocorrelation is symmetry,

, which is easy to prove from the definition. In the continuous case,

, which is easy to prove from the definition. In the continuous case,

- the autocorrelation is an even function

-

when

when  is a real function,

is a real function,

- and the autocorrelation is a Hermitian function

-

when

when  is a complex function.

is a complex function.

- The continuous autocorrelation function reaches its peak at the origin, where it takes a real value, i.e. for any delay

,

,  . This is a consequence of the Cauchy–Schwarz inequality. The same result holds in the discrete case.

. This is a consequence of the Cauchy–Schwarz inequality. The same result holds in the discrete case.

- The autocorrelation of a periodic function is, itself, periodic with the same period.

- The autocorrelation of the sum of two completely uncorrelated functions (the cross-correlation is zero for all

) is the sum of the autocorrelations of each function separately.

) is the sum of the autocorrelations of each function separately.

- Since autocorrelation is a specific type of cross-correlation, it maintains all the properties of cross-correlation.

- The autocorrelation of a continuous-time white noise signal will have a strong peak (represented by a Dirac delta function) at

and will be absolutely 0 for all other

and will be absolutely 0 for all other  .

.

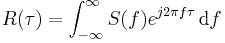

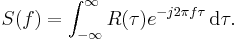

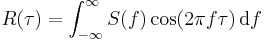

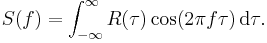

- The Wiener–Khinchin theorem relates the autocorrelation function to the power spectral density via the Fourier transform:

- For real-valued functions, the symmetric autocorrelation function has a real symmetric transform, so the Wiener–Khinchin theorem can be re-expressed in terms of real cosines only:

Efficient computation

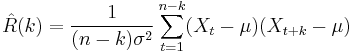

For data expressed as a discrete sequence, it is frequently necessary to compute the autocorrelation with high computational efficiency. While the brute force algorithm is order  , several efficient algorithms exist which can compute the autocorrelation in order

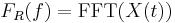

, several efficient algorithms exist which can compute the autocorrelation in order  . For example, the Wiener–Khinchin theorem allows computing the autocorrelation from the raw data

. For example, the Wiener–Khinchin theorem allows computing the autocorrelation from the raw data  with two Fast Fourier transforms (FFT)[2]:

with two Fast Fourier transforms (FFT)[2]:

where IFFT denotes the inverse Fast Fourier transform. The asterisk denotes complex conjugate.

Alternatively, a multiple  correlation can be performed by using brute force calculation for low

correlation can be performed by using brute force calculation for low  values, and then progressively binning the

values, and then progressively binning the  data with a logarithmic density to compute higher values, resulting in the same

data with a logarithmic density to compute higher values, resulting in the same  efficiency, but with lower memory requirements.

efficiency, but with lower memory requirements.

Estimation

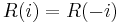

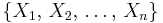

For a discrete process of length  defined as

defined as  with known mean and variance, an estimate of the autocorrelation may be obtained as

with known mean and variance, an estimate of the autocorrelation may be obtained as

for any positive integer  . When the true mean

. When the true mean  and variance

and variance  are known, this estimate is unbiased. If the true mean and variance of the process are not known there are a several possibilities:

are known, this estimate is unbiased. If the true mean and variance of the process are not known there are a several possibilities:

- If

and

and  are replaced by the standard formulae for sample mean and sample variance, then this is a biased estimate.

are replaced by the standard formulae for sample mean and sample variance, then this is a biased estimate. - A periodogram-based estimate replaces

in the above formula with

in the above formula with  . This estimate is always biased; however, it usually has a smaller mean square error.[3][4]

. This estimate is always biased; however, it usually has a smaller mean square error.[3][4] - Other possibilities derive from treating the two portions of data

and

and  separately and calculating separate sample means and/or sample variances for use in defining the estimate.

separately and calculating separate sample means and/or sample variances for use in defining the estimate.

The advantage of estimates of the last type is that the set of estimated autocorrelations, as a function of  , then form a function which is a valid autocorrelation in the sense that it is possible to define a theoretical process having exactly that autocorrelation. Other estimates can suffer from the problem that, if they are used to calculate the variance of a linear combination of the

, then form a function which is a valid autocorrelation in the sense that it is possible to define a theoretical process having exactly that autocorrelation. Other estimates can suffer from the problem that, if they are used to calculate the variance of a linear combination of the  's, the variance calculated may turn out to be negative.

's, the variance calculated may turn out to be negative.

Regression analysis

In regression analysis using time series data, autocorrelation of the errors is a problem. Autocorrelation of the errors, which themselves are unobserved, can generally be detected because it produces autocorrelation in the observable residuals. (Errors are also known as "error terms" in econometrics.)

Autocorrelation violates the ordinary least squares (OLS) assumption that the error terms are uncorrelated. While it does not bias the OLS coefficient estimates, the standard errors tend to be underestimated (and the t-scores overestimated) when the autocorrelations of the errors at low lags are positive.

The traditional test for the presence of first-order autocorrelation is the Durbin–Watson statistic or, if the explanatory variables include a lagged dependent variable, Durbin's h statistic. A more flexible test, covering autocorrelation of higher orders and applicable whether or not the regressors include lags of the dependent variable, is the Breusch–Godfrey test. This involves an auxiliary regression, wherein the residuals obtained from estimating the model of interest are regressed on (a) the original regressors and (b) k lags of the residuals, where k is the order of the test. The simplest version of the test statistic from this auxiliary regression is TR2, where T is the sample size and R2 is the coefficient of determination. Under the null hypothesis of no autocorrelation, this statistic is asymptotically distributed as  with k degrees of freedom.

with k degrees of freedom.

Responses to nonzero autocorrelation include generalized least squares and the Newey–West HAC estimator (Heteroskedasticity and Autocorrelation Consistent).[5]

Applications

- One application of autocorrelation is the measurement of optical spectra and the measurement of very-short-duration light pulses produced by lasers, both using optical autocorrelators.

- For measuring particle size distributions of very fine particles or micelles suspended in a fluid. A laser shining into the mixture produces flicker, which correlates with the motion of the particles. Autocorrelation of the signal gives a picture of the diffusion speeds of the particles. From this, knowing the viscosity of the fluid, the sizes of the particles can be calculated.

- In optics, normalized autocorrelations and cross-correlations give the degree of coherence of an electromagnetic field.

- In signal processing, autocorrelation can give information about repeating events like musical beats (for example, to determine tempo) or pulsar frequencies, though it cannot tell the position in time of the beat. It can also be used to estimate the pitch of a musical tone.

- In music recording, autocorrelation is used as a pitch detection algorithm prior to vocal processing, as a distortion effect or to eliminate undesired mistakes and inaccuracies.[6]

- Autocorrelation in space rather than time, via the Patterson function, is used by X-ray diffractionists to help recover the "Fourier phase information" on atom positions not available through diffraction alone.

- In statistics, spatial autocorrelation between sample locations also helps one estimate mean value uncertainties when sampling a heterogeneous population.

- The SEQUEST algorithm for analyzing mass spectra makes use of autocorrelation in conjunction with cross-correlation to score the similarity of an observed spectrum to an idealized spectrum representing a peptide.

- In Astrophysics, auto-correlation is used to study and characterize the spatial distribution of galaxies in the Universe and in multi-wavelength observations of Low Mass X-ray Binaries.

- In panel data, spatial autocorrelation refers to correlation of a variable with itself through space.

- In analysis of Markov chain Monte Carlo data, autocorrelation must be taken into account for correct error determination.

See also

- Autocorrelation technique

- Autocorrelator

- Correlation function

- Correlogram

- Cross-correlation

- Galton's problem

- Partial autocorrelation function

- Fluorescence correlation spectroscopy

- Optical autocorrelation

- Pitch detection algorithm

- Variance

- CUSUM

- Cochrane–Orcutt estimation (transformation for autocorrelated error terms)

- Prais–Winsten transformation

References

- ^ a b Patrick F. Dunn, Measurement and Data Analysis for Engineering and Science, New York: McGraw–Hill, 2005 ISBN 0-07-282538-3

- ^ Box, G. E. P., G. M. Jenkins, and G. C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Upper Saddle River, NJ: Prentice–Hall, 1994.

- ^ Spectral analysis and time series, M.B. Priestley (London, New York : Academic Press, 1982)

- ^ Percival, Donald B.; Andrew T. Walden (1993). Spectral Analysis for Physical Applications: Multitaper and Conventional Univariate Techniques. Cambridge University Press. pp. 190–195. ISBN 0-521-43541-2.

- ^ Christopher F. Baum (2006). An Introduction to Modern Econometrics Using Stata. Stata Press. ISBN 1597180130. http://books.google.com/?id=acxtAylXvGMC&pg=PA141&dq=newey-west-standard-errors+generalized-least-squares.

- ^ Tyrangiel, Josh (2009-02-05). "Auto-Tune: Why Pop Music Sounds Perfect". Time Magazine. http://www.time.com/time/magazine/article/0,9171,1877372,00.html.

![R(s,t) = \frac{\operatorname{E}[(X_t - \mu_t)(X_s - \mu_s)]}{\sigma_t\sigma_s}\, ,](/2012-wikipedia_en_all_nopic_01_2012/I/6e9629360e96440ba70ae96aa45e8921.png)

![R(\tau) = \frac{\operatorname{E}[(X_t - \mu)(X_{t%2B\tau} - \mu)]}{\sigma^2}, \,](/2012-wikipedia_en_all_nopic_01_2012/I/a026344ac80dfcf7df93a56f04897c48.png)

![R_{ff}(\tau) = \operatorname{E}\left[f(t)\overline{f}(t-\tau)\right]](/2012-wikipedia_en_all_nopic_01_2012/I/6dd3dcc9a8c29fa6880ae03b377a15a5.png)

![R_{xx}(j) = \operatorname{E}\left[x_n\,\overline{x}_{n-j}\right].](/2012-wikipedia_en_all_nopic_01_2012/I/c61456b7bb00244529bfc8175c5d8649.png)